Forming the perfect premium confectionery products

Inspecting extrusion wheel

As buying behaviour among consumers continues to evolve on a global scale, optimised forming and extrusion technology is being increasingly used by snack manufacturers. Daisy Phillipson reports

The global demand for indulgent snacks with a healthy twist has been increasing steadily over the past decade, with premium confectionery set to drive market growth between now and 2026.

There are infinite NPD opportunities associated with the premium segment, as it encompasses so many overarching trends such as convenience, protein, better-for-you options and healthful eating. Since the confectionery and snack sectors are among the most competitive in FMCG manufacturing, new product development remains an invaluable weapon for suppliers in their battle to hold onto their share. In order to do so, a heavier reliance on efficient and flexible machinery offering more than its intended function is paramount.

The forming and machinery market is no exception, with automation and smart technology helping to drive down manufacturing costs and ensure productivity at these critical steps of the production process.

One company that is evolving and adapting in accordance with customer requirements is leading expert in extrusion and co-extrusion technology, Extrufood. The premiumisation of snack products, driven by an increased interest in health, nutrition and food ethics, is fuelling the need for more flexible equipment capable of handling shorter runs and faster changeovers.

The same rule applies in the context of confectionery products. By applying these market shifts to development strategies, Extrufood made a breakthrough in creating a range of 100 per cent fruit snacks using its cooking and forming extruders.

As the company explains, the most important aspect of extrusion is a more homogenous and consistent cooking process, which leads to a final product of a consistently higher quality. When this process is combined with the use of real fruit juices and purees with natural colours and flavours, the result is a wide range of premium, healthier confectionery products.

Within its present range of continuous production equipment options, Extrufood is able to supply new and upgraded versions of existing equipment in order to help meet customers’ requirements. Addressing the need for greater flexibility and unique candy designs, the firm revealed it has been developing an innovative eight-colour extrusion system, adding that further details will be released ‘very soon’.

A growing demand for organic and natural candies is expected to aid market growth within the confectionery segment. A strong perception among consumers is that these products provide health benefits while also being of a higher quality to traditional sweets. Of course, there is room for confectionery from both ends of the spectrum, and this is precisely where BCH comes in.

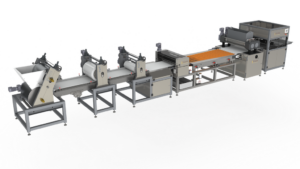

The company offers everything from turnkey lines to standalone systems, as well as bespoke and tailor made solutions. Its flexible extruders are primarily designed for liquorice, starch gels, fruit twists and sugar pastes, and are manufactured with 75, 130 or 200mm diameter screws to produce a broad range of throughputs of between 50 and 1500kg an hour through a side flow die configuration. These can be designed to extrude sheets, ropes and twisted ropes in solid, hollow or co-extruded form.

Addressing the surge of healthy snack ranges, a highlight in the company’s recent achievements arrived with the development of a 100 per cent fruit cooking and extrusion system. Utilising BCH’s large surface area MaxiVap Evaporator technology, users are able to achieve evaporation of high moisture fruit mixes to typically 85 per cent solids, at which point they have a consistency of a soft dough that can be extruded using BCH extrusion technology.

Other than creating products using just fruit ingredients, another technique that encompasses so many trends is the use of fruit and nut inclusions. While this idea has been around for some time, in recent years, suppliers have increasingly placed these components on the surface of a snack product or in conjunction with functional ingredients and superfoods. Even the ice cream category – traditionally associated with high fat, dairy and sugar content – has been stepping up its innovation game to raise both the health and visual profile of indulgent desserts.

A challenge that arises when adding large and uneven fruit and nut pieces to stick-based ice cream is that conventional processing methods can often result in misplaced sticks or inclusions, leading to costly waste and downtime. To overcome these roadblocks, food processing and packaging solutions firm Tetra Pak launched an extrusion system capable of producing stick ice cream products with large-sized inclusions at high capacity.

The Tetra Pak extrusion wheel, which can be added to existing lines, reverses the traditional method of stick ice cream production. Rather than inserting the stick at the end of the processing line, it is there from the start, so the ice cream containing large pieces is then filled around it.

This maintains the position of the stick and the integrity of the inclusions, which can be up to 25mm in diameter. The wheel design includes moulding cavities ensuring uniform product shapes and a smooth surface.

Raising the bar

As well as candy and desserts, forming and extrusion systems are integral to the overall efficiency of many snack manufacturing plants. Snacking occasions have been steadily rising in recent years. In fact, snacking is preferred to eating meals for 59 per cent of adults worldwide. Common interests in health and wellbeing, alternative diets and unique flavour profiles have driven a rise in premium products hitting the market. By ticking all of the boxes, as well as the added benefit of convenience, the snack bar segment is one of the fastest- growing. In the context of bar forming, confectionery and snack machinery specialist Sollich KG’s Conbar range is proving popular with manufacturers due to its flexibility.

Different styles such as cereal, nutrition, brittle, candy and fruit bars are made possible by the forming lines. Then there are the styles: single- and multi-layer products with an additional layer of yogurt, cream, caramel, fruit mass or filling can be produced, as well as rectangle cuts and stamped bars with a variety of cross-sections. “If required, a following chocolate enrobing line, either for only bottom or full enrobing, including the possibility of a decoration increases the range of products which can be produced on the Conbar lines,” adds Sollich’s Ralf Schäffer.

From visuals to edibles

Accommodating such a wide range of choice leaves plenty of room for NPD in the snack bar department. Although the protein bar market is established, the range of variants continues to soar alongside sales. Vegan bars, for example, contain plant-based alternatives to dairy protein such as pea derivatives and peanut powder. Functional ingredients such as CBD oil, reishi mushrooms and chia seeds present additional consumer benefits.

Mike Sherd, project manager at Egan Food Technologies, explains: “Many of our customers are looking to expose the more beneficial and premium inclusions, for example by sprinkling dried fruit onto the top of their products.” In addition, cannabis-infused snack bars are now popular in regions where the psychoactive plant has been legalised for medicinal or recreational use.

When it comes to the forming process, Egan Food Technologies offers two types of customisable slab forming line for either start-up manufacturers or established edibles processors. The equipment gently, uniformly presses dough across a 16-inch-wide belt surface, making it ideal for handling fragile materials. Pressing rolls are adjustable for bar thickness and accommodate product inclusions. Like the company’s other equipment, the Slab Forming Line is designed to scale as demand for an end-user’s cannabis-infused bars grows.

Discussing the outlook for these trends, Sherd concludes: “Scientists are always looking to introduce their well-known products in fresh, new ways and meet evolving consumer demand. Gluten-free is another area of focus, as are natural inclusions and cannabis edibles, all of which I see continuing in the months to come.” Market reports support Sherd’s statements, with the cannabis edibles and gluten-free snack sectors expected to be worth £3.3 billion by 20223 and £35.4 billion by 2027,4 respectively.