As the company noted, in Africa, mobile payments increased 39% annually between 2010 and 2020, and the global pandemic made them an even more prominent payment option on the continent. The mobile money economy has also extended allied financial services like credit, savings, and insurance to the traditionally unbanked. This means that even in remote farming villages with no banks, cocoa farmers have access to these financial services through their mobile phones and local payment agents. Such communities have become increasingly comfortable with sending and receiving digital payments.

Barry Callebaut hails progress on cocoa farmer digital payments

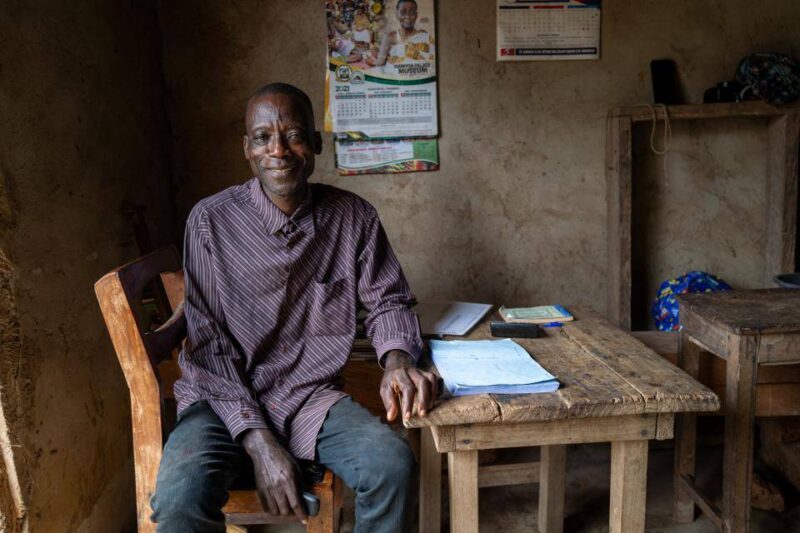

pic: Barry Callebaut

Barry Callebaut has highlighted notable progress with thousands of additional farmers beginning to receive digital payments for their beans, offering a secure system that enhances traceability of farmer income, reports Neill Barston.

The delivery of online payment within agriculture has been gaining traction in recent years, and has been considered by some industry observers as holding the key to driving overall income standards for core communities serving the confectionery sector, including in West African nations of Ghana and Ivory Coast, which account for two thirds of the global market.

As Swiss-headquartered Barry Callebaut noted, its digital payment system has been linked to the sale of beans that are part of certified or verified cocoa programmes such as Rainforest Alliance or Cocoa Horizons generate additional premiums.

According to the company, digitising transactions offer a more credible record of farmer income, with the business noting that until recently, many agricultural workers would look forward to their harvests with both excitement and anxiety. The business added that exclusion from formal financial services, limited access to credit, and low financial literacy can result in unpaid bills and lack of income until a cash payment is received. In addition, transporting and delivery of bulk cash payments can be a risky business.

“Payment digitisation is a key part of Forever Chocolate, our plan to make sustainable chocolate the norm. It supports the financial inclusion of cocoa farmers and secures the traceability and reliability of most cocoa premiums currently paid by our customers. Full transition to digital payments will come in the near future,” explained Nicolas Mounard, VP Sustainability and Farming.

As the company added, further rolling-out of digital payments is an actionable step towards its goal to lift cocoa farmers out of poverty and supports the professionalisation of farming practices. Furthermore, the company notate that while cocoa farmers have a solid understanding of sustainable agricultural practices, their main struggle is access to investments in their farms. In response, the company offers support through subsidised soil inputs, planting material, financial support for third-party labor services and additional premiums.

Digital premium payments benefit cocoa farmers by establishing credible income records and accelerating financial inclusion. Such information is vital to enable access to additional finance for farm inputs and equipment. For women farmers in particular, digital payments provide greater financial autonomy. These payments eliminate the need to spend their income on traveling to major cities for cash payments and securing childcare in their absence. Our digital payment program has also facilitated thousands of West African farmers to obtain a national ID by working with community and government authorities.

South American success

After decades of farmer-level cash transactions, cocoa farmers in Brazil and Ecuador were the first in Barry Callebaut’s supply chain to go digital with payments. In Ecuador, the practice began in 2020 and payments were made annually for the first two years. The early adopters, mostly large-scale farmers, now have more experience and are paid after each delivery, while newer members are paid quarterly. Improving the acceptance of digital premiums over cash is a work in progress, especially among small-scale farmers, but skepticism toward digital payments continues to dwindle. In Brazil, many cocoa farmers who sell directly to Barry Callebaut have bank accounts to facilitate digital payments. Cocoa premiums are paid within a few hours of delivery. A project to make premium payments through the country’s central bank instant payment system has been initiated to make digital transfers both instant and free for Brazilian cocoa farmers.

African progress

Barry Callebaut started to digitise the payment of cocoa premiums to West African farmers, producing sustainable cocoa, for the 2021/22 season and made good strides. In a first step, over 18,000 farmers received digital premiums, and 44,000 were registered for digital accounts. Through Barry Callebaut’s Cocoa Horizons programme in Cameroon, almost half of all cocoa purchased is paid for digitally, and the majority of cocoa cooperative members had their premiums digitised.

Meanwhile, in Indonesia, the company engages with around 40,000 cocoa farmers, with a move to digitisation only being brought in last August, with a successful pilot relating to digital cocoa premiums. This was trialled with a total of 1,200 farmers who have been enrolled in the system, with the company confirming that this was set to be extended. further this year.